Interim Market Update

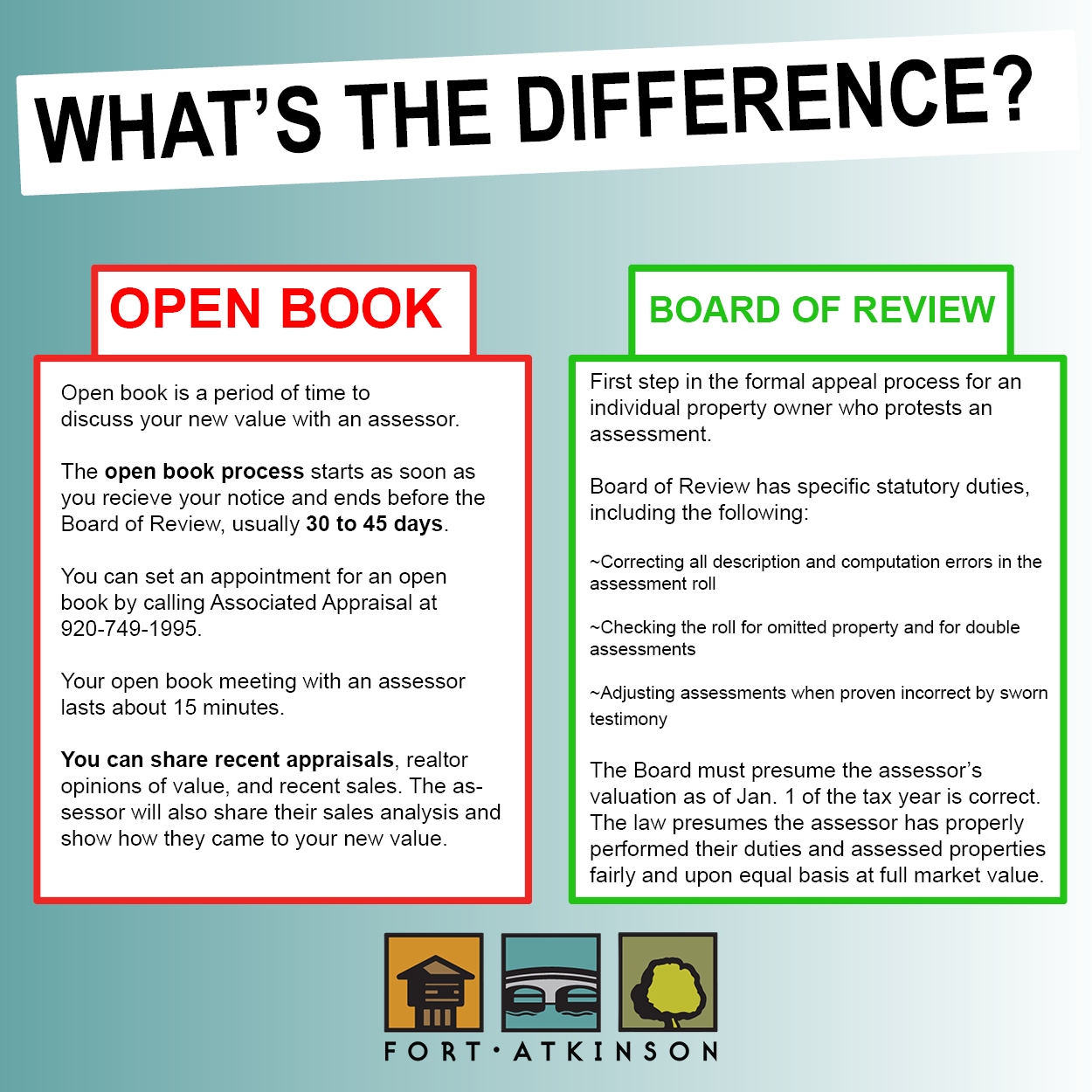

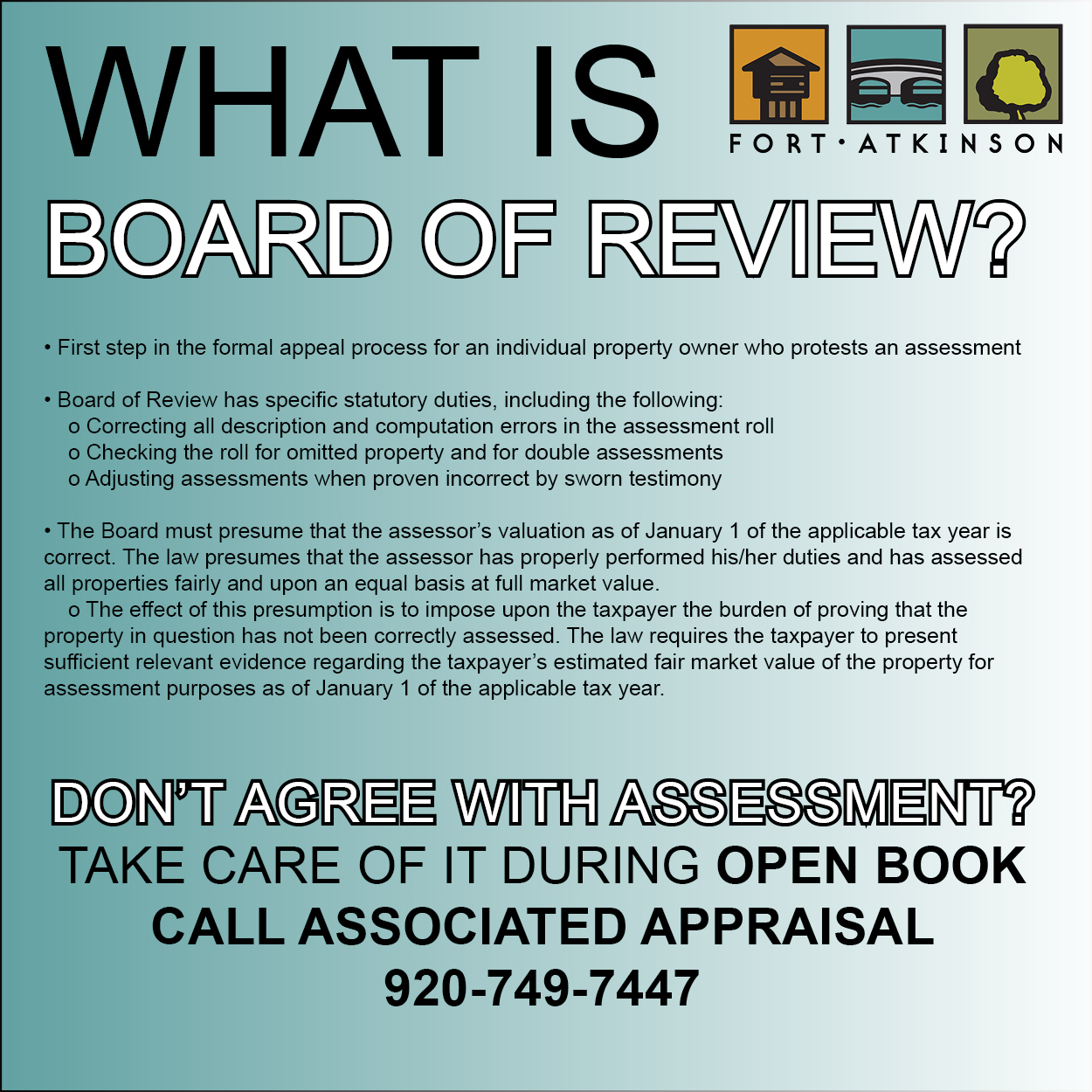

Open Book will be held Wednesday, Aug. 30, 2023, from 10 a.m. to 4 p.m. in-person only at 101 N. Main St., and on Aug. 31 and Sept. 12 from 11 a.m. to 3 p.m. by phone only. Open Book appointments can be made by calling 920-749-1995.

Board of Review will be held Sept. 26, 9 a.m.-11 a.m., and as needed at the Fort Atkinson Municipal Building, 101 N. Main St., Fort Atkinson, WI 53538. Those wishing to appear before the Board of Review must complete and submit an Objection to Real Property Assessment, form PA-115A and submit it to Clerk Ebbert. Clerk Ebbert will contact individuals to schedule an appointment.

What is an Interim Market Update?

The Fort Atkinson City Council approved an interim market update with Associated Appraisal, the City’s contracted assessor in January. Property owners in the City will receive a letter regarding the new assessed value of properties.

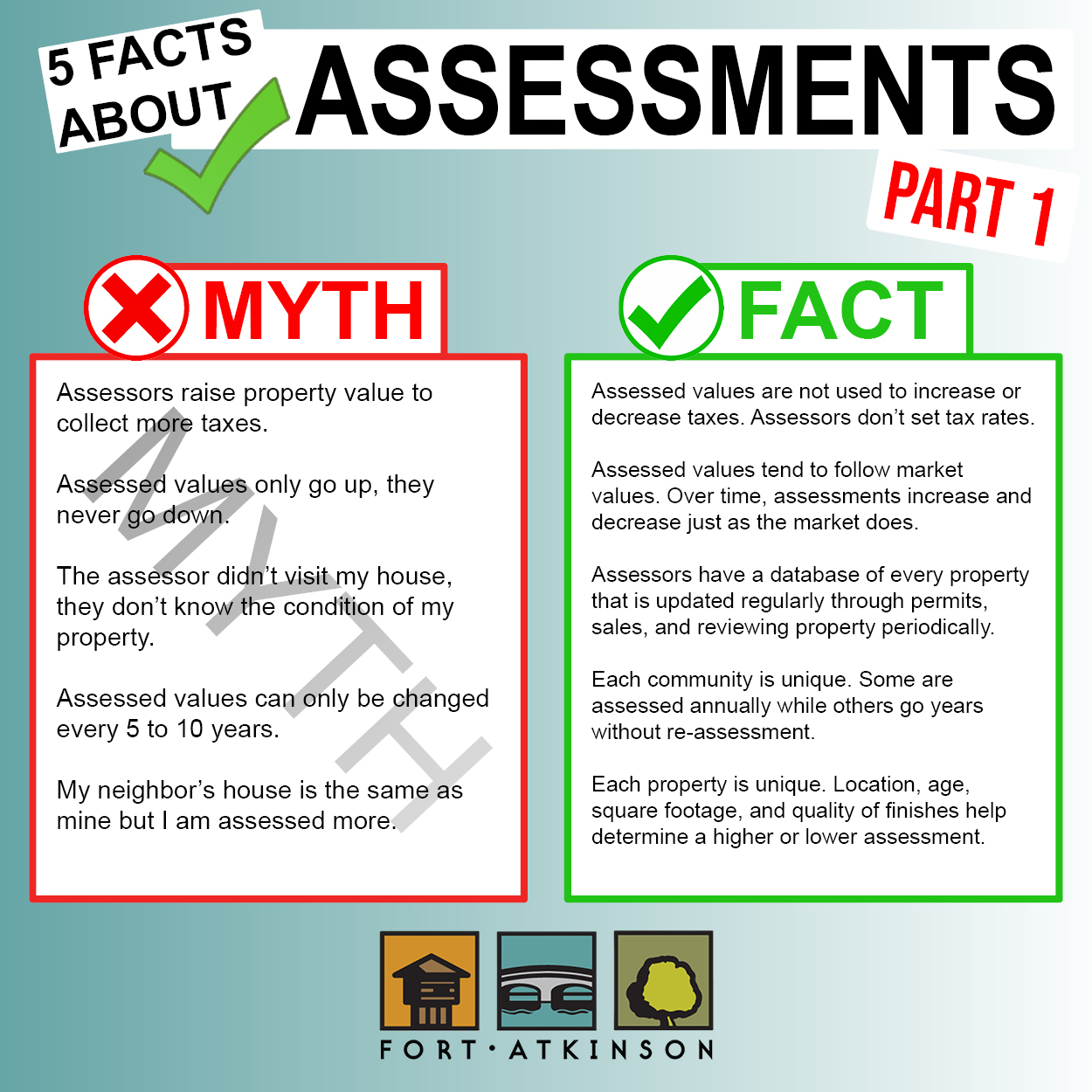

A property assessment is the value an assessor places on each taxable parcel and personal property within a municipal jurisdiction. This value determines the proportion of the local property tax levy for which each property owner is responsible. State Law requires the overall assessment ratio to be within 10% of market value. The goal is that assessed value reflects the market value.

The City of Fort Atkinson has not been in compliance with State Statues relating to assessment ratio since 2019. If a municipality is out of compliance for five years in a row, the State will perform a revaluation at the municipality’s expense.

Because the City last performed a full revaluation in 2017, Associated Appraisal recommended the option for an Interim Market Update (IMU). The IMU meets the State requirements for compliance without the intensity and expense of a full revaluation. This update will be performed with an end goal of recalibrating the assessed values of the properties within the City and being compliant with State Statutes. This process is critically important in maintaining equity between and among all taxpayers.

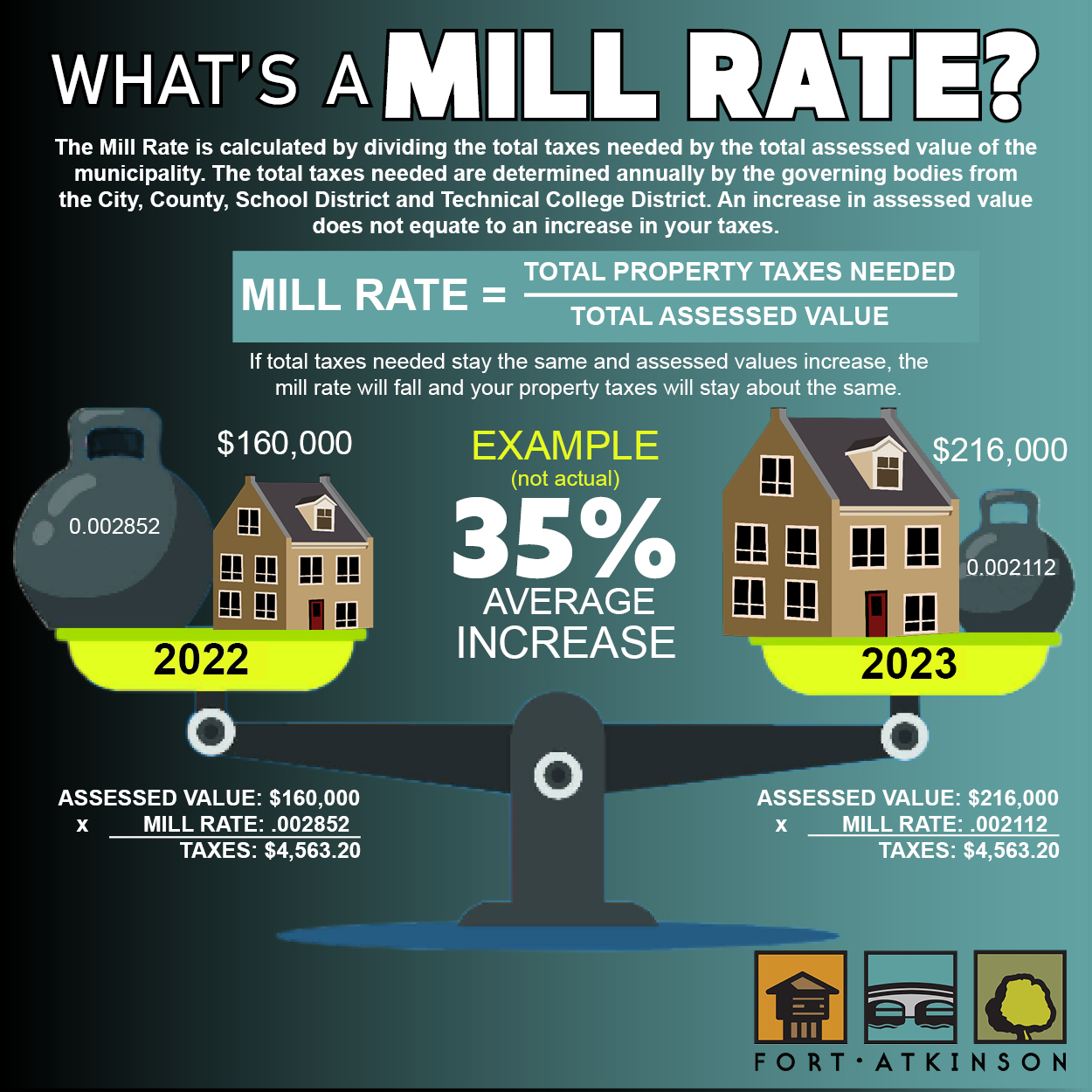

Property taxes are calculated by multiplying the assessed value of the land and improvements on a property by the mill rate. The mill rate is determined after all four taxing jurisdictions determine their budgets for the next year. When the assessed value of a property increases, the mill rate decreases, and the total property tax bill generally remains the same. The interim market update and any associated increase in assessed property values does not in and of itself increase taxes.

The timeline for the IMU is already underway with the Assessor collecting field data. This process may take a few months with notices being mailed out within the next couple of months. The dates for 2023 Open Book and Board of Review have not yet been set.

More information will be shared on this website as it becomes available. Please continue to check back here or visit the City’s Facebook page for updated information.